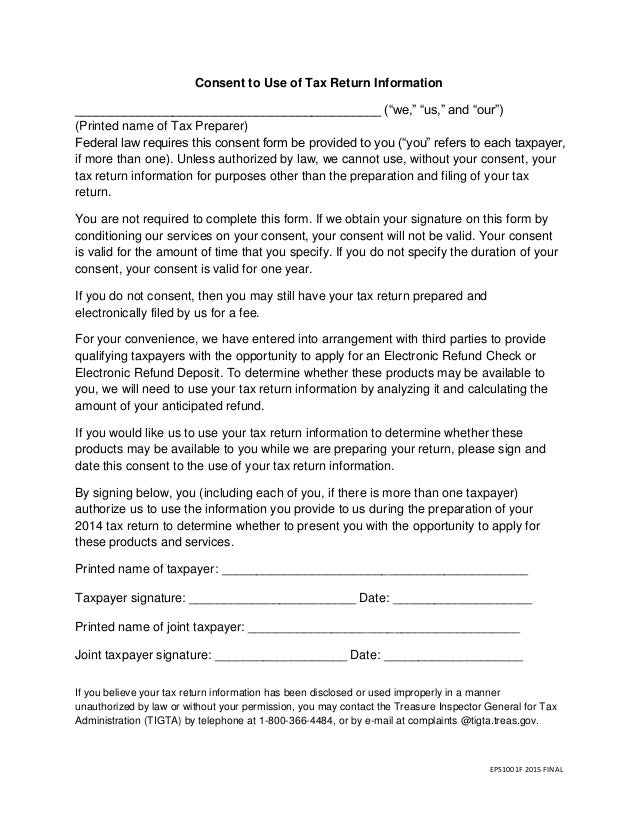

Taxpayer Consent To Use Tax Return Information Pursuant To

Mychart Login Page

Authorization to release income tax return information. federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return. Consumer's rights with respect to their medical records hhs hipaa home for individuals your medical records this guidance remains in effect only to the extent that it is consistent with the court’s order in ciox health, llc v. azar, no.

By madhu nutakki, computerworld the healthcare it spotlight provides tips, guidance, predictions, methodologies and best practices for the implementation and use of authorization to release income tax return information technology by the healthcare industry. one of the many miracles that the. Hennepin healthcare is an integrated system of clinics, from primary and specialty care to home care and hospice, rehabilitation, and trauma services.

What Are Tax Brackets And How Do Federal Income Tax Brackets Work

It’s a patient’s right to view his or her medical records, receive copies of them and obtain a summary of the care he or she received. the process for doing so is straightforward. when you use the following guidelines, you can learn how to. Jan 04, 2021 · contact the office of vital records: health. vitalrecords@state. mn. us or 651-201-5970. mailing address minnesota department of health office of vital records po box 64499 st. paul, mn 55164-0499 courier/fedex/ups delivery address minnesota department of health office of vital records 100 e 7th street st. paul, mn 55101.

East lake clinic. temporarily closed, providers now at whittier clinic 2700 east lake street, suite 1100 minneapolis, mn 55406. In evaluating your claim, the adjuster will request your medical records, and could ask for an independent medical examination (ime). updated by david goguen, j. d. as your personal injury case proceeds, the insurance adjuster will want to g.

Umdnj-department of university affairsrecords, 1954-2013 a guide to the collectionjune 1981 revised june 2005rg/c-482-15, 93-43, authorization to release income tax return information 96-27, 96-81, 05-02 department history the department of university affairs advances the university's mission through: a comprehensive program of publications to inform readers about university news, trends in health care, research breakthroughs,. In the united states, every working person who earns more than a certain amount of money each year needs to pay income taxes to the federal government. not everyone pays the same amount, though; the u. s. uses a progressive tax system, which. As the old adage goes, taxes are a fact of life. and the more we know about them as adults the easier our finances become. there are many things to learn to become an expert (this is why we have accountants), but the essentials actually are.

3 11 3 Individual Income Tax Returns Internal Revenue Service

How To Track An Income Tax Return Finance Zacks

For states, health plans, and providers looking to improve care delivery for medicaid’s sickest, costliest patients. three of the programs identified for this analysis the camden coalition, careoregon, and hennepin health -are participants in the center for health care strategies’ (chcs) complex care innovation lab. this.

The american tax system isn’t known for being the most straightforward set of laws and processes to follow, and being responsible for determining what you owe each year can seem confusing — if not a little anxiety-inducing, too. fortunately. Medical records how to obtain medical records. should you require a copy of medical records for yourself or on behalf of an adult family member, please use the guidelines below. in order to. protect your privacy or the privacy of your loved one, proper identification will be required to obtain medical records. Moore medical supply is a company based in connecticut that sells a wide variety of medical and healthcare equipment. the company serves healthcare providers who need to purchase supplies for non-hospital medical facilities as well as priva. Under internal revenue code (irc) section 7216 and its concomitant regulations, a tax preparer must obtain the consent of a taxpayer before disclosing or using the taxpayer’s tax return information when that consent is required. section 7216 makes it a crime for any preparer to knowingly or recklessly disclose any information that is furnished to the preparer in connection with preparing a client’s tax return, or use tax return information other than to prepare or assist in preparing.

What can we help you find? enter search terms and tap the search button. both articles and products will be searched. please note: if you have a promotional code you'll be prompted to enter it prior to confirming your order. if you have an. Medical news and health news headlines posted throughout the day, every day written by jennifer m. ellison, ma and andrea r. semlow, ms, mph and emily c. jaeger, mph and erin m. bergner, mph, ma and elizabeth c. stewart, drph and derek m. g.

They are kept separate from the patient’s medical and billing records. hipaa also does not allow the provider to make most disclosures about psychotherapy notes about you without your authorization. corrections. if authorization to release income tax return information you think the information in your medical or billing record is incorrect, you can request a change, or amendment, to your record. Authorization to release income tax return information federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation and filing of your tax return. if you consent to the disclosure of your tax.

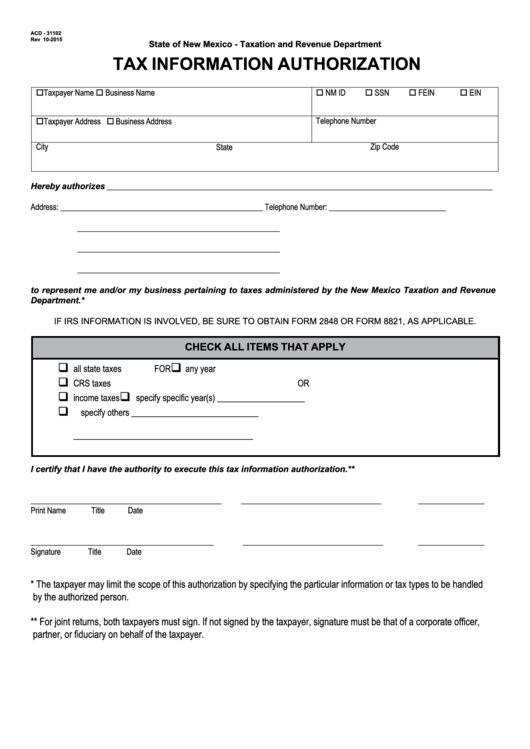

Whether you're interested in reviewing information doctors have collected about you or you need to verify a specific component of a past treatment, it can be important to gain access to your medical records online. this guide shows you how. This form authorizes the release and sharing of individual information which includes: prior year tax returns and supporting document associated with those tax returns, as well as personal information such as name, birth date, social security number,.

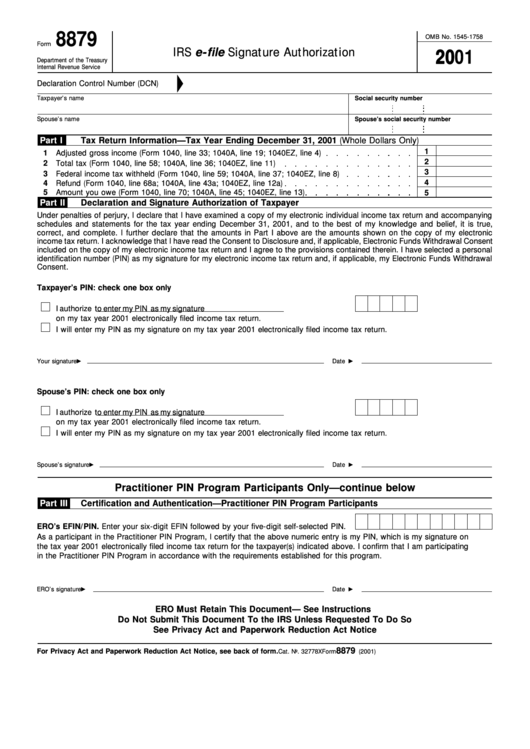

An official website of the united states government november 13, 2020 (1) this transmits revised irm 3. 24. 3, isrp system, individual income tax returns. (1) irm 3. 24. 3. 1. 8 removed form 1040a and form 1040ez. (2) irm 3. 24. 3. 1. 9 removed form. Dr. meghana d gadgil, md, is an internal medicine specialist in san francisco, california. she attended and graduated from umdnj-new jersey medical school in 2007, having over 14 years of diverse experience, especially in internal medicine. she is affiliated with many hospitals including ucsf medical center. dr. Struggling with your own files or those of a loved one you care for? due to interest in the covid-19 vaccines, we are experiencing an extremely high call volume. please understand that our phone lines must be clear for urgent medical care n. An official website of the united states government december 11, 2020 (1) this transmits revised irm 3. 11. 3, returns and documents analysis individual income tax returns code and edit. (1) irm 3. 11. 3 this irm has been rewritten to provi.

For a copy of your medical record, please hand deliver, mail, or fax a dd form 2870 (authorization for disclosure of medical or dental information). please note: we need an original signature from the requester to fully process a request. links. state of maryland division of vital records birth and death records; u. s. navy bureau of personnel homepage. In the united states, you have the legal right to obtain any past medical records from any hospital or physician. retrieving old records, even those stored on microfilm, can be a simple process, depending on the hospital's policy for storin. Health partners: 952-883-7400. hennepin health: 1-800-647-0550. ucare: 612-676-6830. resources and reimbursement. if you want reimbursement for mileage and parking expenses even if you are in a health plan, or if you receive your care "fee for service" (not enrolled in a health plan) and need assistance with medical transportation:. To request a copy of a medical record or radiology images (x-ray films) from university hospital's health information management (medical records) department, begin by printing a hipaa-compliant authorization form available in english or en espanol. complete the entire form, taking note of the following information:.